A case study on how Paraguay could save millions by reducing late payments in public procurement

On February 11, 2013, a contractor presented an invoice after finishing a contract with Paraguay’s health ministry to buy office equipment. But the firm didn’t receive the payment for the goods until six months later. These types of delays in payments to providers that sell goods, works and services to the government are common in Paraguay’s public procurement. From 2011 to 2017, around 80% of public contract invoices were paid late, costing the state $143.2 million.

These findings were part of an investigation that used open data on public contracts to analyze costs in the payment stage of the contracting process and propose changes. Governments sometimes struggle to pay suppliers on time, which creates inefficiencies and financial costs. When invoices are not paid promptly, firms that provide goods, services and public works to the government encounter short-term liquidity problems. This might force businesses to turn to the financial market to cover their obligations, use their savings, or go out of business. If money is lent from the financial market, providers incur extra costs due to interest rates, which are then built into the providers’ cost structure and passed on to the government. Other studies have found that this practice can ultimately affect economic growth. Moreover, according to the World Bank, if this procedure becomes the norm, suppliers may decline to do business with the government, which reduces competition and makes it harder for purchasing entities to ensure value for money.

Data used

To analyze public procurement payments, we used datasets from the Treasury’s open data portal. In Paraguay, open contracting data includes all stages of the procurement process, from the bid preparation (planning) and tender to the implementation of the contract, including payments to providers. Thanks to this level of detail, we were able to build a database where each observation corresponded to an invoice for a public contract from a public institution, from 2011 to 2017. The database had the following variables:

- Contracting procedure data: date of the contract, contract ID number, name of the provider, procuring entity, type of funds used for payment, type of purchase, contract amount.

- Invoice data: invoice amount and dates for each stage of the payment process.

- Institutional data: other open datasets were used to obtain the current payroll of each institution (https://datos.hacienda.gov.py/data/nomina) and their budget execution (https://datos.hacienda.gov.py/data/pgn-gasto)

To estimate the cost, we used the following variables from open data portals:

What we analyzed

We analyzed the duration of each stage of the payment process and identified which variables could affect the duration.

We also calculated the financial cost of the payment duration, using the amount of each invoice, the average lending rate, and the payment duration.

What we found

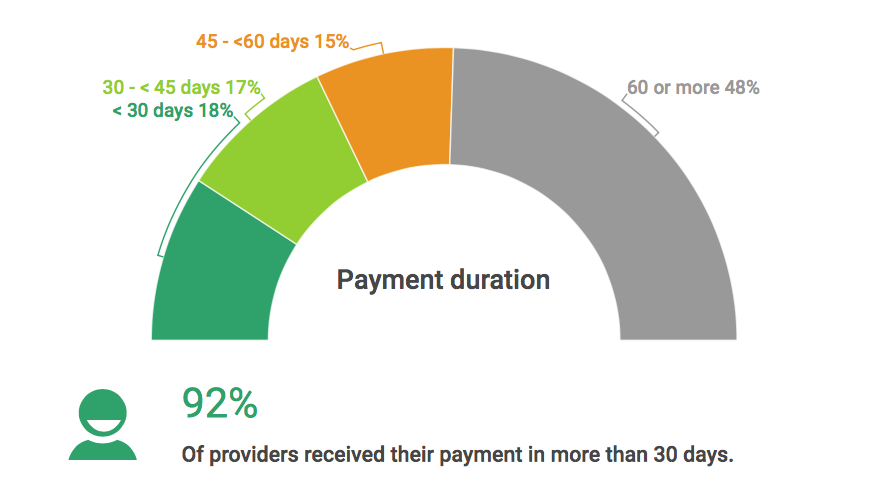

80% of invoices were paid after more than 30 days, which is over the optimal time to execute payments (that is, up to 30 days); 48% took more than two months (60 days). The delay affected 92% of providers.

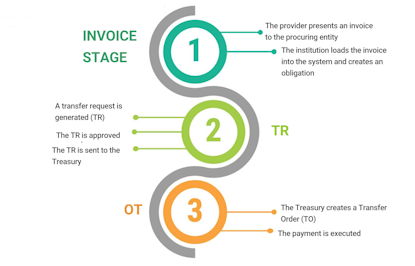

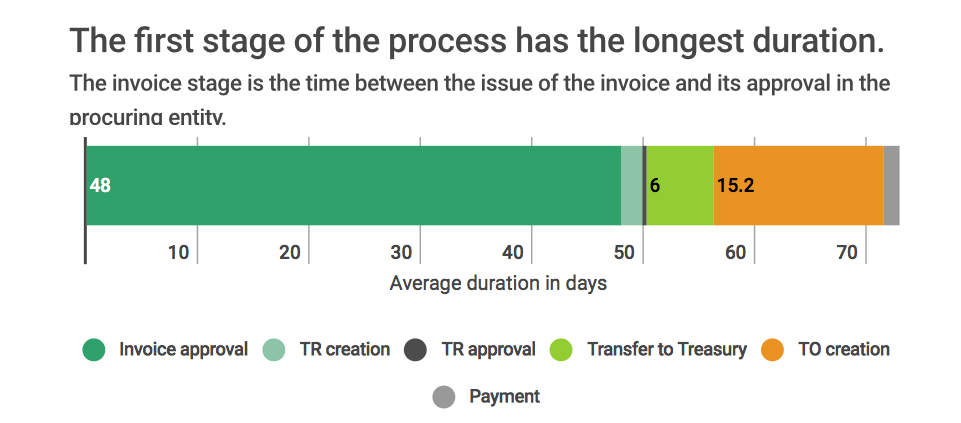

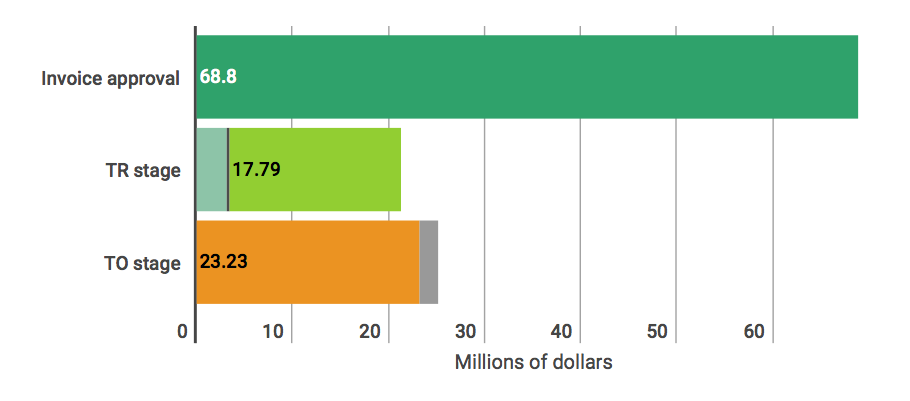

The first stage of the process takes the longest. This stage begins the moment a contractor presents an invoice and ends when the institution loads it into the system and creates an obligation. Before this happens, the Treasury is not aware of how many invoices are outstanding. This stage takes 48 days on average and it’s the longest across all institutions.

Moreover, the transfer order (TO) creation is the second slowest stage; this step comprises the time between when the transfer request (TR) is dispatched to the Treasury and the transfer order is created. Neither of these two stages have a specific deadline according to current regulations.

The payment duration spiked after 2012: it increased from 37 days to more than 52 in subsequent years. This was likely influenced by pay raises approved for public servants between 2011 and 2012, which in turn increased spending on wages by 44% between 2011 and 2017. In contrast, spending on budget items related to public contracts only grew by 11% during the period analyzed. This caused liquidity problems for the government, which had more trouble assigning funds to pay contracts.

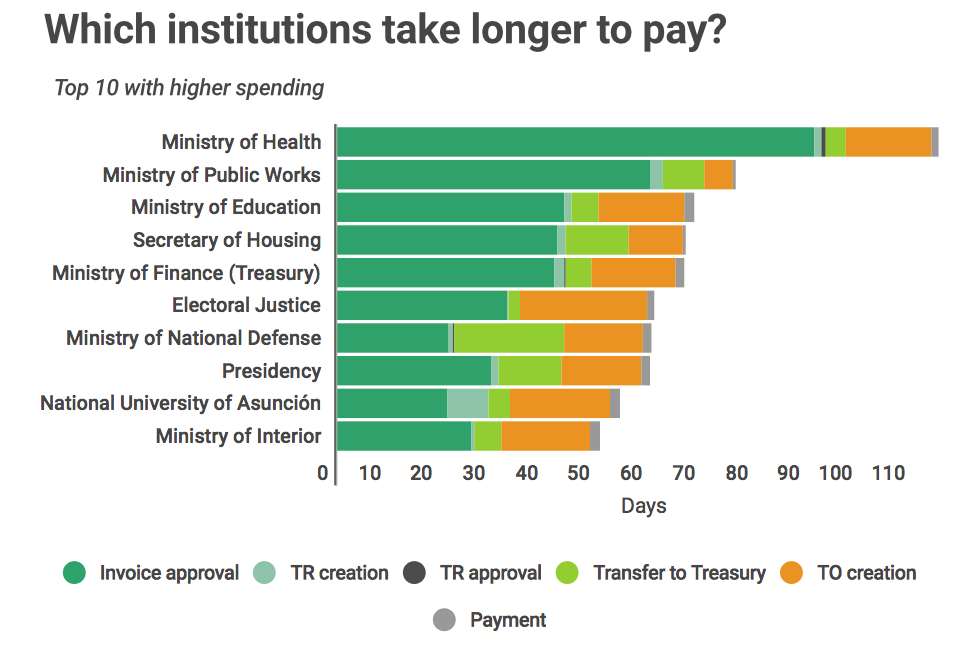

We also found that payment duration varies according to the type of funds used to pay the invoice. For instance, bills paid with Treasury funds (from tax income), took longer. In addition, the bigger the institution and the poorer its budget execution, the longer the payments took.

How much does it cost?

Between 2011 and 2017, the total cost of late payments was $143.2 million. This is twice the price of the construction of Costanera Norte in the capital, Asunción, one of the biggest infrastructure projects in Paraguay; or equal to 0.48% of the 2017 GDP.

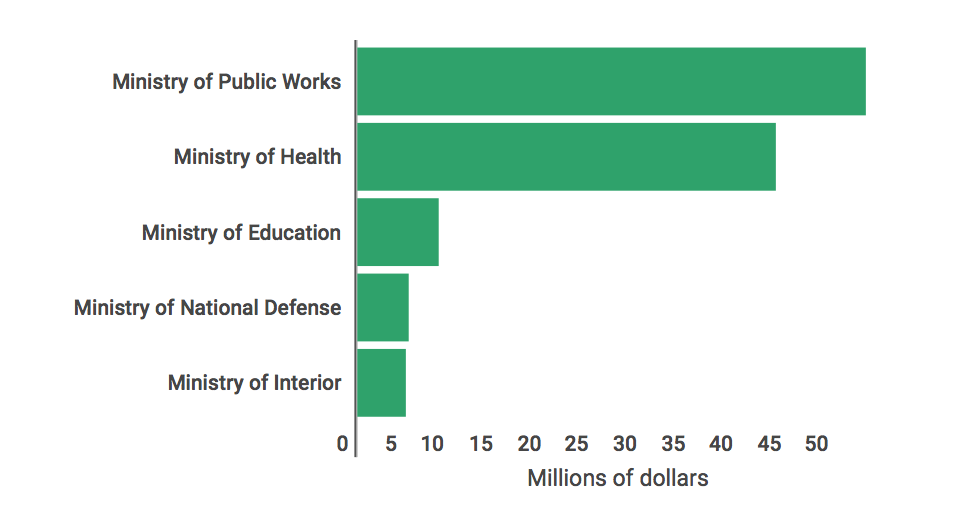

The ministries of public works and of health concentrate most of the cost; together they account for $95 million. Moreover, the invoice approval stage is the most costly. This means that procuring payment practices must be improved in these institutions and in the first stage of the process, in order to obtain the biggest savings.

How much could the government save?

If the deadline for executing total payments were 45 or 30 days since the invoice was issued, the cost could be reduced by 42% or 52%, respectively. If the deadline for approving invoices were 15 days, costs could be reduced by 48%.

This work demonstrates how public procurement open data can be analyzed to generate high-value insights for the government, to improve contracting practices and save public funds. Our methodology can be implemented in any country that publishes payment and contracting data in open formats and aims to serve as an example of how institutional efforts to publish detailed open data about all steps of the procurement process can pay off when valuable insights are derived from its analysis.

The research has been carried out by Juan Pane, Camila Salazar, Julio Paciello of the Centro de Desarrollo Sostenible, Paraguay. You can read our complete paper and methodology here, and access the code and databases used here.