Using open data & open government principles to sell state assets: Prozorro.Sale

Challenge: To maximize state revenue through effective and impartial asset sales

A lot of what we focus on at the Open Contracting Partnership is how government is spending your money on public contracts, but there is an equally profound challenge with the management and sale of government assets. Lousy management, poor inventory oversight, and dodgy dealings are rife. It’s a particularly evident challenge in post-Soviet countries, where states own huge amounts of assets (after all they were the economy) and there is little to no culture of economic returns.

Ukraine, before the Revolution of Dignity, was a poster child for mismanagement and cronyism. Witness the mysterious bargain sale of the Presidential Dacha at Mezhyhirya Presidential Residence to its then incumbent Viktor Yanukovych via anonymous shell companies in the UK and elsewhere.

The national state asset sales system has been sclerotic and looted for many years, with restricted competition, unclear tender procedures, no data on performance or inventory, and no public oversight. These shortfalls reportedly restricted access to deals, which resulted in below-market transaction prices.

Now, the open contracting approach that was so important in improving Ukraine’s public procurement was adapted to help fix this problem as well. The ProZorro reforms, developed for the public sector by the Ministry of Economic Development and Trade in partnership with Transparency International Ukraine, technology experts, and businesses, are guided by the key principle of “everybody sees everything.” This approach builds on radical transparency, centralized performance monitoring, customer participation, and an enhanced buyer experience.

Solution: Secure & user-friendly online auctions that are visible to everyone

In 2016, the transparent electronic state asset sale system called ProZorro.Sale was developed to allow anyone to bid on auctions that are tamper-proof and visible to everyone. Compared to the traditional auction system, data seen by OCP suggests that sellers on ProZorro.Sale generate more revenue (especially from small-scale privatization) and trade items faster, while buyers have more confidence in the system.

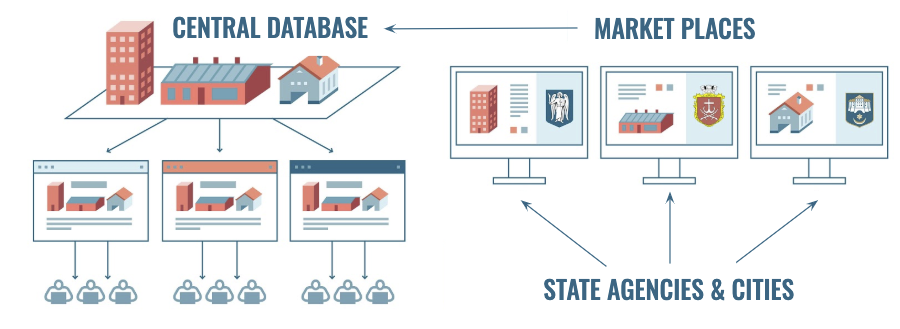

The two-tier auction system consists of more than 50 commercial e-trade platforms that connect to a central database (using APIs), meaning the auctions are visible on all platforms and sellers and buyers can choose to deal through whichever one of the 50 or so service-providers best suits their needs. All data about previous auctions is accessible through the central database (bids, dates, contracts, etc). And the system’s performance and integrity can be monitored by anyone via the public business intelligence (BI) module: https://bi.prozorro.sale.

At present, the system can be used to sell and lease around 34 different types of assets, including those from failed banks, as well as other government national and sub-national agencies and some commercial firms. Items up for auction include credit portfolios, state-owned enterprises, mining licenses, land, vehicles, billboard advertising rights, buildings, scrap, and minor assets, such as cars or computers. With complementary regulatory reforms, the system could be expanded to other areas, such as timber auctions, renewable energy and private bankruptcy procedures.

How open contracting helps

ProZorro.Sale is powered by open source, open data technology, modelled on the Open Contracting Data Standard (OCDS), a universal schema that allows information to be collected, centralized and published in a standardized and structured way. The OCDS guides governments what information to publish at each stage of the public contracting process—from planning to tender to award to implementation of contracts—using a unique ID to link information across different datasets within government. Repurposing existing technology that used the OCDS allowed the asset sales team to build the e-auction system within four months and for a cost of US$100,000.

It enables users and partners around the world to publish shareable, reusable, machine-readable data, to join that data with their own information, and to create tools to analyze or share that data. For Prozorro.Sale, the OCDS was adapted with relevant extensions to collect and publish information around assets.

Key results

We are studying the effects of Prozorro.Sales in collaboration with Kyiv School of Economics, Transparency International and the Prozorro.Sale team. We want to share some of the very promising early indicators here.

1. More revenue

In less than three years, ProZorro.Sale has generated UAH 17.6 billion (more than US$600 million) in revenue, according to figures from the system’s business intelligence module. In small-scale privatization alone, the system has generated UAH 1 billion in a year, more than the amount raised through conventional privatization sales in Ukraine in the previous four years.

2. Better prices

Prices are rising to market value. For small privatizations, the average auction starting price has increased by 75% over six months. According to Ukrainian Railways (Ukrzaliznytsia), which leased a small number of train carriages via ProZorro.Sale to determine the market price, the carriages’ starting price reportedly increased by 100% over 450 successful auctions, indicating that they were dramatically undervalued before. Starting prices for property leases have grown by 25% on average and sales by Ukrainian Post have risen notably too.

3. More buyers

The number of users is increasing steadily; almost 800 sellers and 13,000 bidders have registered as of June 2019. Potential buyers can access information about items up for sale through more than 50 different platforms across Ukraine. They can also see all historic data on sales & statistics. This does help: buyers gain analytical capacity, allowing them to make better buying decisions. In the past, the majority of sales failed to attract any buyers, according to practitioners from various government agencies, while the new system has an average competition of 2.5 bidders per item. In 2016, the top 5 buyers generated more than 80% of overall revenue, while the latest figures from 2019 show a drop to just above 50%, indicating an increase in buyer diversification. Most buyers are Ukrainian, but several big purchases have been made by foreigners, such as a German company that bought ferro alloy from a state-owned enterprise for around US$1 million.

4. More successful and efficient sales

Fewer attempts are required to make a successful sale. Around 60% of items are sold within the second auction announcement. While accurate figures on successful auctions before ProZorro.Sale was introduced are unavailable, experienced practitioners report that most auctions failed to attract buyers. It takes a month and a half on average for a transaction to be completed after a successful auction.

5. Improving trust

Most buyers perceive the system as useful and trustworthy. A survey of 275 companies registered on the system found that almost 75% trust it, about 70% said it improved their business and more than 30% used information from the system for other purposes beyond identifying opportunities, such as analysing market composition and prices.

If you would like to find out more about the Prozorro transparency reforms, or whether such an approach is right for you, email kgranickas@open-contracting.org.